To know more about Free Insurance under EPF – EDLI click here

Under any insurance scheme you can exactly tell what your Claim amount would be and it wont be different from time to time.For E.g if you say 10 Lakhs and it would be 10 Lakhs throughout the period whereas in EDLI scheme under EPF it’s different.

Claim amount Calculation

Claim amount under EDLI = (30 x Basic Salary) + (50% of your Average Balance in EPF account)

- Basic Salary refers to Last Drawn Salary before a member’s Death

- Salary is not your Gross Salary (You might be getting say 100,000 but your basic might be just 50,000)

- 50% of your Average Balance refers to the Balance during last 12 months or during the entire membership (whichever is lower)

- Total Ceiling under Average Balance is 1,50,000

- Total Maxiumum Ceiling is 6 Lakhs

E.g

Let say

- Member ‘A’ has a Basic Salary of 50,000

- Member ‘A’ s average Balance is 2 Lakhs

Then the Claim amount is

(50% of Average Balance) = 50% of 2 Lakhs = 1,00,000 (Maximum Ceiling is 1.5 Lakhs)

Basic Salary x 30 = (30X30,000) = 9,00,000 = 5,00,000 (Since Maximum Ceiling is only 6 lakhs and you have already got 1 Lakh as 50% of your Average Balance)

So Actual Claim amount is = 5 Lakhs + 1 Lakh = 6 Lakhs

To know more about Free Insurance under EPF – EDLI click here

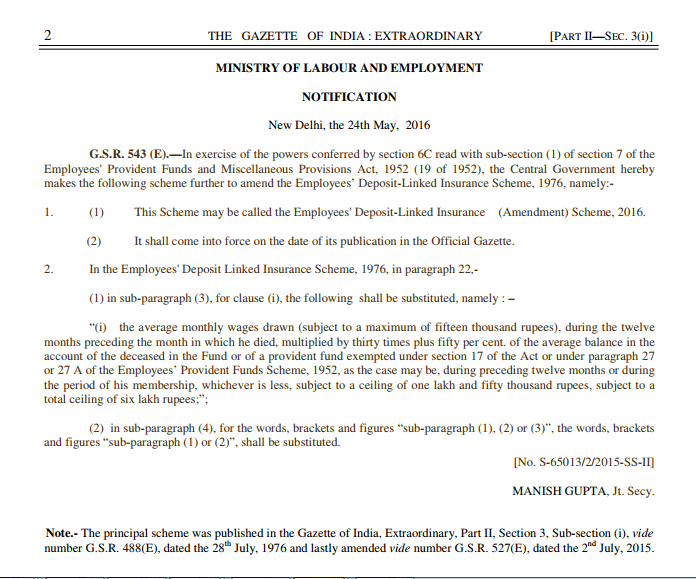

Gazette Notification of the below order

Shan is an expert on on Employees Provident Fund, Personal Finance, Law and Travel. He has over 8+ years of experience in writing about Personal Finance and anything that resonates with ordinary citizens. His posts are backed by extensive research on the topics backed by solid proofs